How Donald Trump’s “Big, Beautiful Bill” May Affect Social Security

With recent policy changes under the Trump administration, many retirees are wondering how the so-called “Big Beautiful Bill” may affect their finances, specifically their Social Security income. The bill does include a senior tax deduction that reduces or eliminates federal income tax on Social Security benefits for millions of older Americans. While this change offers short-term relief, it also raises questions about the long-term sustainability of the Social Security program.

Who Benefits from the Tax Changes to Social Security Income?

The bill introduces an additional $6,000 deduction for seniors filing individually and $12,000 for married couples filing jointly. This deduction phases out at $75,000 (single) or $150,000 (joint) which means if you claim more income than this, the deduction wouldn’t apply. According to reporting from The Daily Beast, this change could mean that up to 88% of Social Security recipients will no longer owe federal tax on their benefits, compared to roughly 64% under previous tax rules (Brennan).

This deduction is designed to benefit middle-income seniors who were previously subject to tax on a portion of their Social Security income. However, lower-income seniors who were already not taxed on their benefits due to not having enough reportable income to file income taxes will see no change. Likewise, higher-income seniors above the phase-out threshold will not benefit from this deduction.

Who Doesn’t Benefit from the Tax Changes to Social Security Income?

The tax changes don’t affect:

- Low-income seniors already exempt from Social Security taxation.

- High-income retirees who exceed the phase-out threshold of the deduction.

Furthermore, this tax relief is temporary, with the deduction set to expire in 2028 unless further action is taken (Kiplinger; Washington Post).

How Does This Affect Social Security’s Future?

While this policy reduces the tax burden for many retirees, it may also accelerate the depletion of the Social Security trust fund. Before this policy was enacted, the Social Security Trust fund was set to be insolvent by the year 2033.

While the deduction offers short-term relief, it reduces funding for the Social Security trust fund. This may hasten projected exhaustion. The OASI trust fund, which finances Social Security, is estimated to deplete by 2033; this new deduction may accelerate that timeline (Investopedia).

One way the Social Security Trust Fund was funded was through taxation on the Social Security benefits that were paid. According to the Bipartisan Policy Center, removing or reducing the taxation of Social Security benefits without new sources of revenue could push the program closer to insolvency. The Social Security Administration projects that the trust fund could run out as early as 2033 (Bipartisan Policy Center). With this new change, we could expect to see that number change.

What Can Homeowners Do Now?

For homeowners, now is the time to explore alternative sources of retirement income, such as a reverse mortgage, to maintain financial stability regardless of future policy changes. With Social Security’s future uncertain and tax relief measures possibly expiring, seniors who own homes have an often-overlooked source of income: their own home equity.

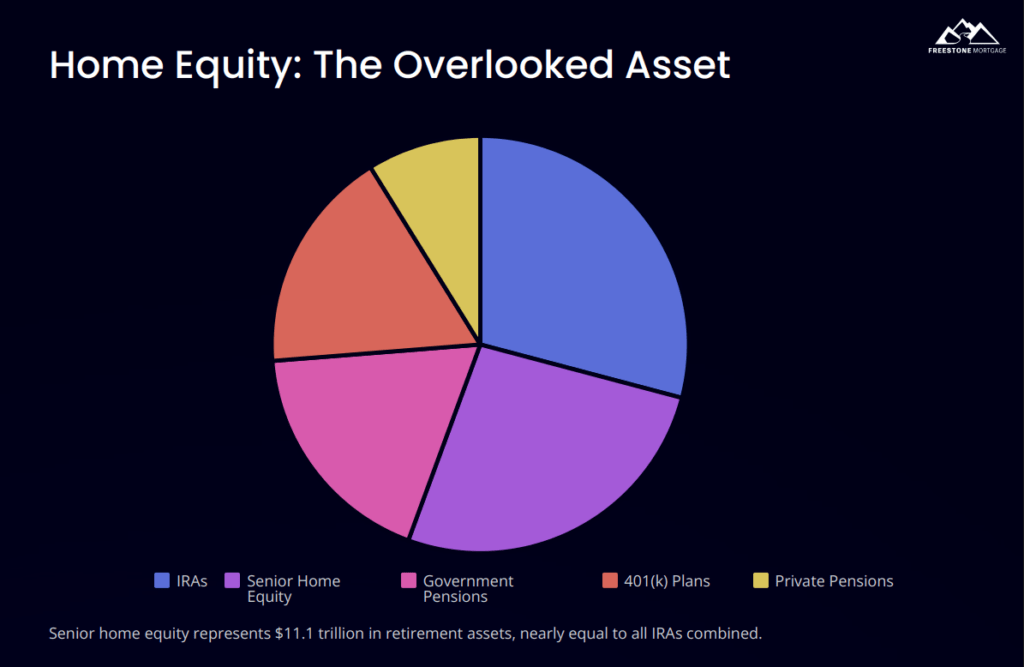

Senior home equity represents $11.1 trillion in retirement assets, nearly equal to all IRAs combined. This home equity can fluctuate as the market changes so when home values are high, it’s a good time for seniors to take advantage of that growth in their home value and make their equity work for them with the deployment of a reverse mortgage.

A reverse mortgage allows someone age 55+ to turn their home equity into cash that they can use as income without it affecting their adjustable gross income. These funds are non-taxable and will not increase your income tax burden. Just the opposite actually: These funds can allow you more control over your taxable income. For example, if you were going to pull funds from an IRA or 401k or other taxable income source and having that income would push you over the threshold to claim this new Social Security tax deduction; if you had a reverse mortgage you could consider pulling the needed funds from your home equity instead, which would decrease your taxable income and potentially place you into the bracket in which this new Social Security tax deduction would apply. Of course, it would be smart to discuss this with an income tax expert before deciding on this plan, but this is a potential option for someone who is looking into ways to control their adjustable gross income and minimize their tax burden.

Reverse mortgages offer several benefits:

- Tax-free income that does not affect Social Security or Medicare benefits.

- Optional monthly mortgage payments, easing cash flow.

- Access to home equity without selling your home.

- No risk of foreclosure due to non-payment of a monthly mortgage burden.

A reverse mortgage can act as a financial buffer, helping seniors supplement their income and delay drawing down retirement assets. This, in turn, can extend portfolio longevity and enhance financial security. Being in control of your income in retirement can bring a sense of well- being and peace. If you are worried about what will happen if the Social Security trust fund does become insolvent or are looking for ways to be more in control your income, you should consider a reverse mortgage.

Bottom Line: Will Social Security Change?

While the Trump-era tax deductions offer immediate benefits to many Social Security recipients, they do not provide a long-term solution to retirement income or Social Security solvency. For homeowners, now is the time to explore strategic ways to supplement income. A reverse mortgage can provide tax-free funds, financial flexibility, and peace of mind in an unpredictable policy environment.

If you’re curious about how a reverse mortgage could fit into your retirement strategy, Freestone Mortgage is here to help. Our experienced team specializes in helping seniors understand and leverage housing wealth to support long-term financial goals.

Works Cited

Bipartisan Policy Center. “The 2025 Tax Bill: Additional $6,000 Deduction for Seniors Simplified.” Bipartisan Policy Center, 2025, https://bipartisanpolicy.org/explainer/the-2025-tax-bill-additional-6000-deduction-for-seniors-simplified.

Brennan, Brian. “Donald Trump Makes Glaring Error as He Touts His Megabill in Victory Speech.” The Daily Beast, 2 July 2025, https://www.thedailybeast.com/donald-trump-makes-glaring-error-as-he-touts-his-megabill-in-victory-speech.

Klein, Betsy. “Trump Tax Changes and Social Security: What It Means for Retirees.” Business Insider, 3 July 2025, https://www.businessinsider.com/trump-tax-social-security-impact-retirees-2025-07.