The Coordinated Withdrawal Strategy: A Smarter Buffer Asset to Safeguard Retirement Portfolios

When clients step into retirement, the greatest threat to their portfolio isn’t necessarily the stock market: it’s the order in which returns arrive. That’s the core concern behind sequence of returns risk, and it’s precisely what the Coordinated Withdrawal Strategy is designed to mitigate.

Combining investment withdrawals with a reverse mortgage line of credit can reduce pressure on retirement accounts and extend portfolio longevity. This use of home equity as a buffer asset can allow you as a financial advisor to strengthen your clients legacy and potentially even grow your AUM without growing your client base.

What Is the Coordinated Withdrawal Strategy?

The Coordinated Withdrawal Strategy is a dynamic approach to using home equity as a buffer asset in retirement. This is a strategy in which you adjust where money comes from based on market conditions:

- When markets are up: Clients draw income from their investment portfolio.

- When markets are down: They pause portfolio withdrawals and draw from a reverse mortgage line of credit instead.

This protects the portfolio from being depleted at the worst possible time, during downturns, allowing assets to recover and reducing the chances of running out of money.

Why It Works: Protecting Against Sequence of Returns Risk

Sequence risk isn’t about average market returns, it’s about when the losses occur. Poor returns early in retirement can force clients to sell investments at a loss to meet income needs, locking in damage that can’t be undone.

The Coordinated Withdrawal Strategy creates a buffer. Instead of drawing from a portfolio that’s down 20%, clients can temporarily use the reverse mortgage line of credit, which is:

✅ Tax-free

✅ Unaffected by the market

✅ Can grow over time

This relieves pressure on investment assets and gives portfolios time to rebound.

Real-World Example: Retiring in 2004 at Age 68

Let’s walk through a sample case using real market returns from 2004–2024.

Meet Jack:

- Retired in 2004 at age 68

- $1,000,000 investment portfolio (60/40 stocks/bonds)

- $350,000 in home equity (owned outright)

- Needs $45,000/year (inflation-adjusted) in retirement income

He has two options:

Scenario A: Traditional 4% Withdrawal Strategy

Jack takes $45,000/year from his investment account regardless of market conditions.

From 2004–2009, the market experienced the Great Recession. In 2008 alone, the S&P 500 lost 37%. Jack continues withdrawing from a shrinking portfolio.

By 2024:

- Jack’s portfolio is severely diminished

- He’s considering reducing lifestyle expenses

- He faces rising healthcare and long-term care costs with limited reserves

- His home has significant value gains

Scenario B: Coordinated Withdrawal Strategy

Imagine instead: Jack opened a reverse mortgage line of credit at retirement in 2004. Based on his age and home value, he would have received an initial line of approximately $150,000, which can grow annually. When the market crashed in 2008–2009, he would have paused portfolio withdrawals and drew from his reverse mortgage LOC instead.

He could have then resumed normal investment withdrawals when the market stabilized.

By 2024:

- Jack’s portfolio is 35% larger than in Scenario A

- His home equity has grown, and his LOC has been replenished or he could have even refinanced to take advantage of lower interest rates and higher home values.

- He maintains flexibility and confidence in future expenses

Key takeaway: The LOC COULD have given Jack the breathing room to avoid locking in investment losses and allowed compounding returns to work in his favor post-crisis.

The Reverse Mortgage Line of Credit Advantage

Unlike a traditional HELOC, a reverse mortgage LOC has unique advantages:

- It can grow over time

- It can’t be frozen or reduced, regardless of housing market or lender policy

- It is non-taxable income and doesn’t affect Social Security or Medicare

This makes it an ideal standby source of liquidity during bear markets or unexpected expenses.

Why Homeowners Should Consider It

Implementing a Coordinated Withdrawal Strategy allows advisors to:

- Reduce client stress during market volatility

- Protect assets under management

- Increase portfolio longevity and legacy value

- Demonstrate proactive, forward-thinking planning

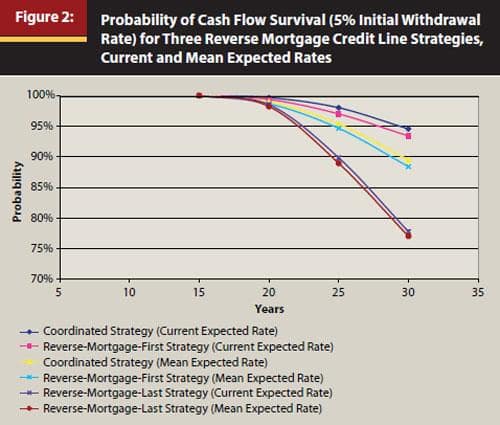

Research by Dr. Wade Pfau and others consistently shows that coordinated strategies outperform last-resort approaches, both in wealth preservation and retirement satisfaction.

Last Resort Approach vs. Proactive Approach to Using Home Equity As Retirement Income

Many retirees and even some advisors view reverse mortgages as a last resort, only to be tapped when all other assets have been depleted. This idea is outdated. Research consistently shows that this approach delivers the worst retirement outcomes. Waiting until the portfolio is exhausted means missing out on the line of credit’s growth potential, limiting flexibility, and increasing the risk of panic-driven financial decisions. In contrast, opening a reverse mortgage line of credit early in retirement creates a powerful safety net, giving clients access to tax-free liquidity exactly when they need it most: before they’re forced to sell assets in a downturn or reduce their lifestyle. Proactive use of home equity isn’t about desperation: it’s about strategic risk management and long-term preservation. This graph from the FinancialPlanningAssociation.org website shows the last resort strategy (red line) as the least resilient option for funding retirement.

Final Thoughts: Integrating Home Equity With The Coordinated Withdrawal Strategy

Home equity is too often overlooked in financial planning—but with trillions in untapped value among seniors, it deserves serious consideration.

By helping clients deploy the coordinated withdrawal strategy across both investment and housing assets, you can offer a more resilient and flexible retirement income plan, without requiring higher risk or more savings.

📞 Want to see how this strategy could look for your client base?

Reach out to our team for a custom analysis and side-by-side scenario modeling using real client data. We’ll help you demonstrate value, build trust, and protect your book in volatile markets.